CHARTS RELATED TO ESTATE TAX DEBATE

SHOWS CONNECTION BETWEEN HIGH ESTATE TAXES

AND LOW SAVINGS RATES

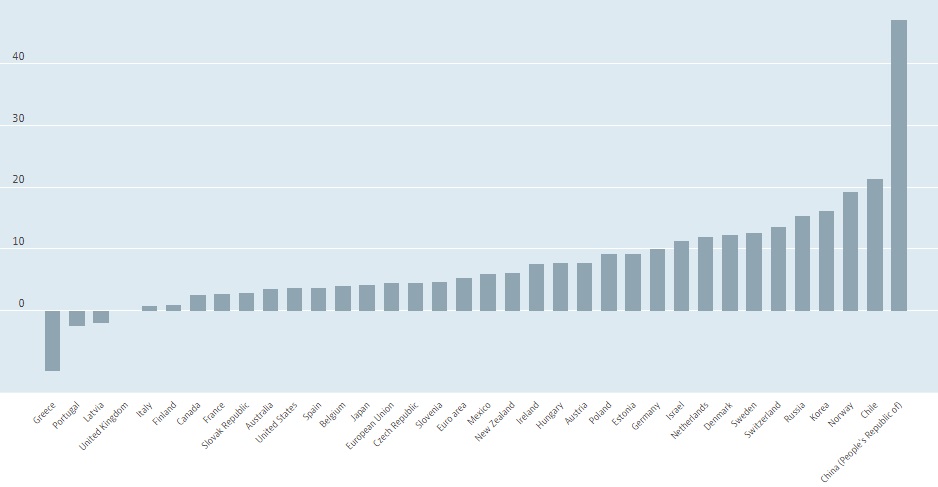

INTERNATIONAL SAVINGS RATES 2015

SOURCE: OECD DATA

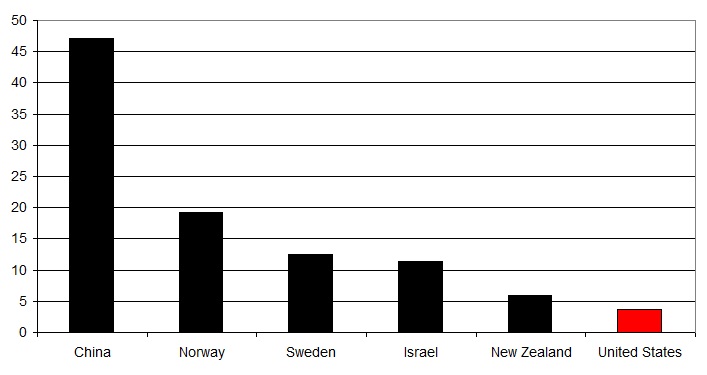

INTERNATIONAL SAVINGS RATES 2015

SOURCE: OECD DATA

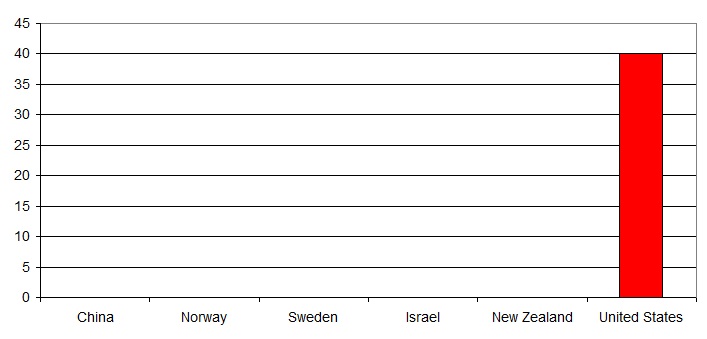

INHERITANCE TAX RATES 2015

SOURCE: TAX FOUNDATION

Top Estate or Inheritance Tax Rates |

||

Ranking |

Country |

Tax Rate |

1 |

Japan |

55% |

2 |

South Korea |

50% |

3 |

France |

45% |

4 |

United Kingdom |

40% |

4 |

United States |

40% |

6 |

Spain |

34% |

7 |

Ireland |

33% |

8 |

Belgium |

30% |

8 |

Germany |

30% |

10 |

Chile |

25% |

11 |

Greece |

20% |

11 |

Netherlands |

20% |

13 |

Finland |

19% |

14 |

Denmark |

15% |

15 |

Iceland |

10% |

15 |

Turkey |

10% |

17 |

Poland |

7% |

17 |

Switzerland |

7% |

19 |

Italy |

4% |

20 |

Luxembourg |

0% |

20 |

Serbia |

0% |

20 |

Slovenia |

0% |

20 |

Australia |

0% |

20 |

Austria |

0% |

20 |

Canada |

0% |

20 |

Estonia |

0% |

20 |

Israel |

0% |

20 |

Mexico |

0% |

20 |

New Zealand |

0% |

20 |

Norway |

0% |

20 |

Portugal |

0% |

20 |

Slovak Republic |

0% |

20 |

Sweden |

0% |

20 |

Hungary |

0% |

OECD Simple Average |

15% |

|

Source: Family Business Coalition. |

SOURCE: TAX FOUNDATION

GLOBAL INCOME INEQUALITY

GINI INDEX 2015

SOURCES: CIA WORLD FACTBOOK