THE CONSUMPTION TAX DEBATE

A PROPOSITION TO TAX SPENDING AND ENCOURAGE SAVINGS

(See also our page on energy taxes.)

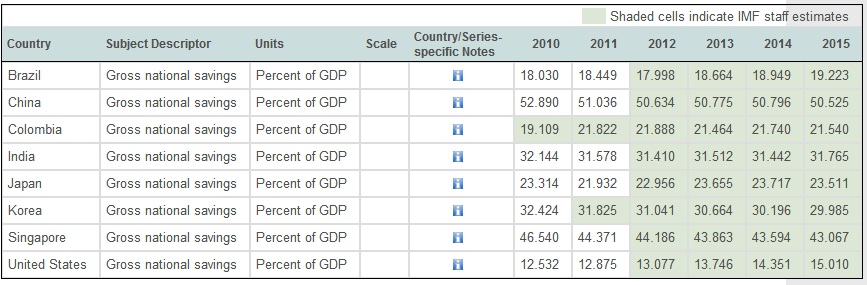

Savings is an area in which Americans fall dangerously behind in comparison to our competitors around the world.

The theory behind a consumption tax is that it will increase savings, since it is consumption itself that is being taxed.

The Value Added Tax is a type of Consumption Tax that 70% of the world's population lives under - and it has been responsible for raising $18 trillion in revenues.

A Value Added Tax (VAT) is a tax on all goods and services at all business stages of production.

Norway has a VAT that goes up to 25%, Germany has a 19% VAT, China has a 17% VAT and India has a 13.5% VAT (VAT Tax Rates Around the World).

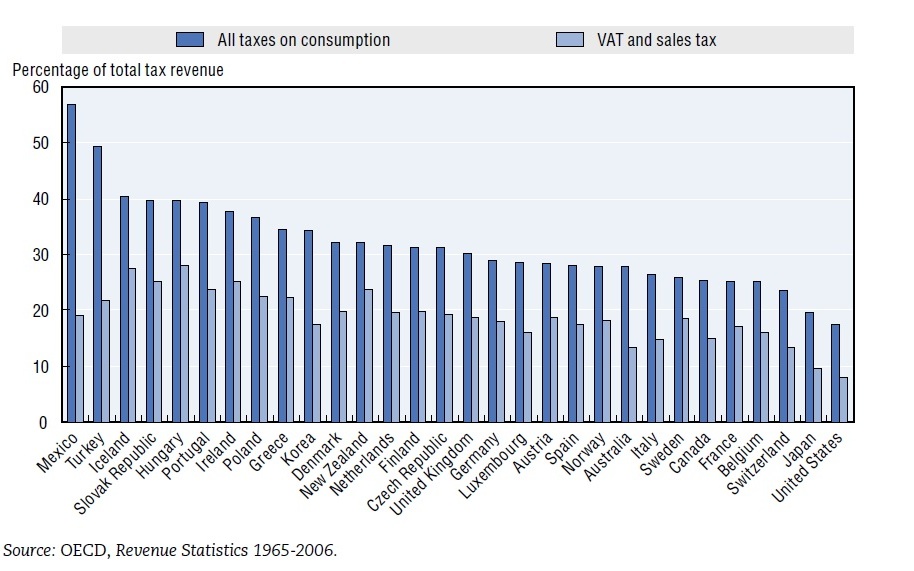

Yet the United States of America has no VAT tax and some of the lowest taxes on consumption in the world as you can see from the chart below.

Instead of a VAT, we have a sales tax that ranges from 1-10% depending on which state the tax is in.

It should be noted that we do not advocate replacing income taxes with a consumption tax,

but rather creating a VAT as a new form of revenue as in Europe.

CONSUMPTION TAXES AROUND THE WORLD

THE DIRE LACK OF AMERICAN SAVINGS

(SOURCE: IMF)

WHAT IS THE CONSUMPTION TAX?

What is the Consumption Tax? (Wikipedia)

Introduction to the Consumption Tax (The Concise Encylopedia of Economics)

The Pros and Cons of a Consumption Tax (Brookings)

National Center for Policy Analysis - Benefits of Tax Reform

Consumption Taxes: (OECD PDF)

Replacing The Income Tax With A Progressive Consumption Tax (American Tax Policy Institute PDF)

A Progressive Consumption Tax? (Forbes)

Unspinning the FairTax (Fact Check)

Tax on Consumption Isn't Quite What You Think (The National Bureau of Economic Research)

Behavioral Economics and the Conservative Critique of VAT (Tax Policy Center)

The Consumption Tax: A Critique (Ludwig Von Mises Institute)

SENATOR BEN CARDIN'S (D-MD) PROGRESSIVE CONSUMPTION TAX ACT 2014

Ben Cardin’s creative proposal for tax reform (The Washington Post, 2-23-15)

What is the Progressive Consumption Tax? (Ben Cardin Senate Web Page)

The goal of Ben Cardin's Progressive Consumption Tax Act is to generate revenue by taxing the purchase of goods and services, rather than income.

It is unlikely that Cardin's plan will pass congress any time soon, but it is a fresh idea from Washington that deserves consideration and discussion.

This act is modeled after the VAT taxes in most OECD countries. Like most sales taxes, the PCT would tax the sale of most purchases at a single rate.

Such a tax would encourage American exports, because it would be destination based. Any goods and services that are exported would not be subject to the tax and exporters would receive a credit for taxes previously paid on inputs.

Cardin also proposes a way for this tax to benefit low income households, by eliminating income taxation for all households earning less than $100,000 and individuals earning less than $50,000, with added rebates to assist families with very low income.

In addition, the ambition for this consumption tax is to make it lower than the OECD average of 19%.

A VALUE ADDED TAX

The United States is one of the few countries in the world that does not have a VAT.

More About the Value Added Tax (Tax Policy Center)

Why a VAT tax is better than a flat tax (Benjamin Cardin)

John McCain's Irresponsible Demagoguery on the VAT (Capital Gains and Games)

McCain's Amendment Against the VAT Tax (United States Senate)

Should the U.S. Institute a National Sales Tax (or Similar Taxes Such as the "Value-Added Tax" or "Fair Tax") to Replace the Income Tax? (Balanced Politics)

U.S. Weighs Tax That Has VAT of Political Trouble (The Wall Street Journal)

Value-Added Tax Would Raise Tons for U.S. Coffers (Bloomberg)

The VAT of the land (The Economist)

America needs a VAT (LA Times)

TAX ANALYSTS

The Political Pathway: When Will The United States Adopt A VAT?

The Conservative Case for a VAT

VAT ABROAD

VAT Tax Rates Around the World