SEVERE MEDICINE FOR SEVERE PROBLEMS

PREPARATIONS FOR THE GATHERING STORM

(For a global perspective on

what is needed, please check out our report

Building a Sustainable Future: An Outline of Reform )

Debt is like a drug. It creates a false sense of security while poisoning the mind and the body.

The delusions of debt can cause people to start believing in an imaginary future. Some conservatives seem to believe in the delusion of painless reform via "cutting government waste". Some liberals believe that all we need to do is to "tax the rich". We favor cutting waste. (Who doesn't.) We also favor raising income taxes on the rich while maintaining incentives for investments. However, the brutal reality of modern America is that these ideas are not enough.

What we are proposing here is a vision of a real future and a recognition of the severe state of America's problems. We cannot report a quick fix. We don't have a painless cure. It took over 30 years of reckless policies to get here. It will take years to get back on track. However, we can meet the challenge of reform if we have the will.

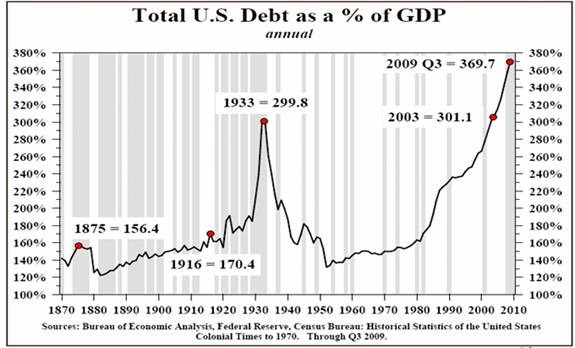

Today, public and private debt in America is at its highest level in history as a share of the GNP. Since 1980 America has been on one of the biggest debt expansions in history. We have gone from being the world's largest creditor to being the world's largest debtor.

Disastrous "free trade" policies have created long term structural trade deficits as America has become dependent on nations like China for goods it used to make at home. A total lack of energy policies has led to record dependence on foreign oil.

While American debt has soared, American savings have collapsed.

In the case of the federal budget astronomical deficits stretch out into the future.

Sadly, the bad news does not end there. America has sustained its giant debt binge by neglecting things like infrastructure spending and reform of a health care system that costs far more and produces far less "care" than other states. Around 30 million Americans still have no health insurance, in spite of the Affordable Care Act. In every other modern state this figure is zero. Meanwhile, giant national and global environment challenges that have been ignored for years now require huge funds.

So what to do?

The cure is going to be painful. However, mindless austerity could set off a death spiral rather than a cure. What America needs to do is to cut consumption, particularly in areas like unsafe energy and increase investments in high technology, infrastructure and energy.

In other words some forms of government spending need to go up sharply, not down.

This is not a comprehensive plan but it does provide some ideas. We shall add more to this later. A key point is the need for far higher levels of taxes. There is no free lunch.

Here is a brief summary of what's needed:

-

Major tax increases across the board on consumption.

-

Reduced taxes on savings and investments.

-

Tax incentives for research and renewable energy projects.

-

Reform of two huge industries funded by government where we spend more and get less on an international basis, health care and education.

-

Increased spending on infrastructure.

-

Increased spending to create universal broad band for all Americans.

-

Increased spending on research.

-

Social security retirement age should be raised.

-

Reduced spending on the military.

There have been moments in our history such after Pearl Harbor and September 11, 2001 when we united in the face of great danger. The national and global economic crisis we face is a direct threat to everything we value. It should produce a level of sacrifice that rises to the challenge. Our ancestors faced far grimmer challenges at places like Valley Forge and Gettysburg.

OVERALL DEBT (PUBLIC AND PRIVATE) IS AT ITS HIGHEST LEVEL IN US HISTORY

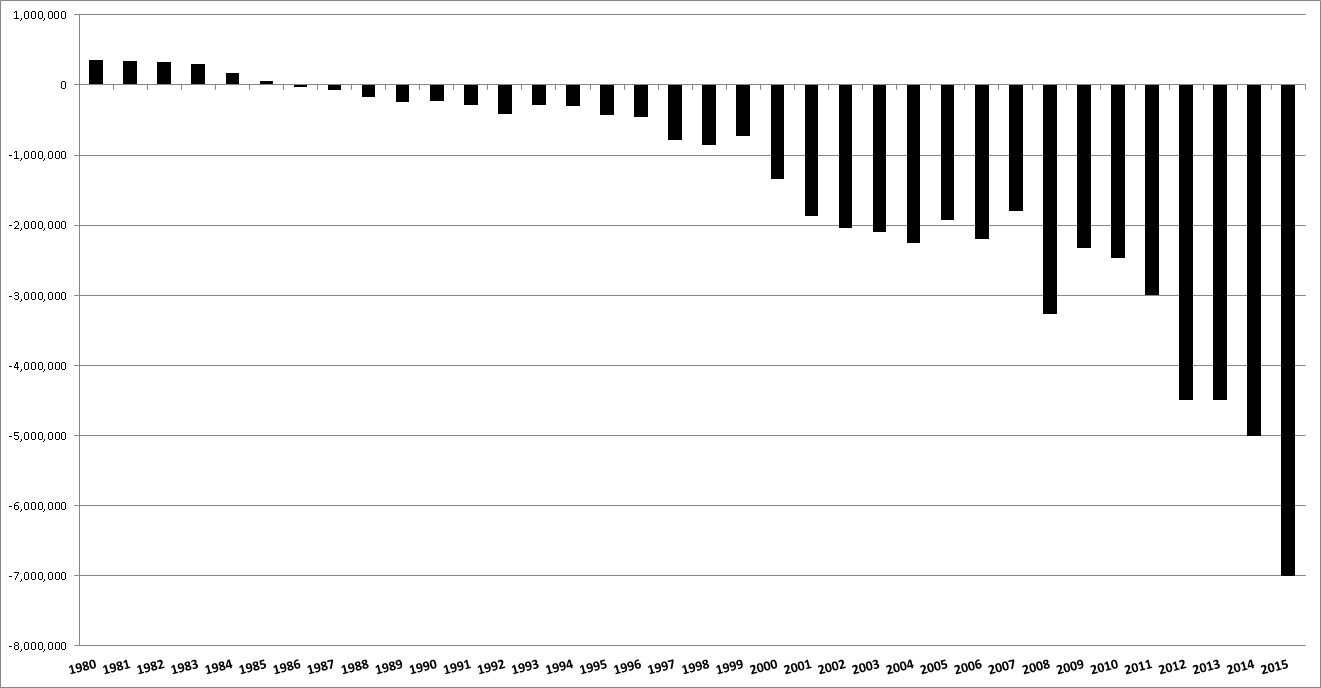

MEANWHILE AMERICA HAS BECOME THE WORLD'S GREATEST NET INTERNATIONAL DEBTOR

SOURCE: U.S. DEPARTMENT OF COMMERCE

America has among the lowest levels of taxation of any modern state as a % of GNP. It also has a relatively low level of government spending as a % of GNP.

Thus, it is totally ridiculous to suggest that "government is too big". A key problem is that the U.S. tax system punishes savings and investment and rewards debt and consumption.

The whole structure of US economic policy is a series of huge subsidies. Thus, it's absurd to suggest that a change in government economic policy is some sort of attack on the free market.

A key point of any tax plan is to increase savings and investment.

Unfortunately, some people are proposing tax "reforms" (like Simpson-Bowles)

that would actually reduce incentives for savings. For example,

some people want to tax long term capital gains as ordinary income.

TAXES ON CONSUMPTION MUST BE RAISED SHARPLY

We favor major increases in consumption taxes and raising taxes on upper income individuals. Meanwhile, taxes on investments should be reduced as noted below.

We certainly don't suggest that all these taxes be raised at once but these suggestions provide a framework for what can be done.

For lower income people a system of tax credits or other means could be developed to reduce the impact of all this.

Almost every other modern state has national consumption taxes and high gas taxes.

See our chart which reveals the folly of past unrealistic tax cuts.

POTENTIAL TAX INCREASES (WE DON'T PROPOSE ALL THESE AT ONCE)

| Taxation Rate | Revenue (billions) | |

| Carbon Tax | ($12.50 tax/$20 per ton of Carbon) | $68.2 |

| Gasoline Tax | (Raised to $1/gallon) | $140.0 |

| Value-Added Tax | Levied at 5% | $189.0 |

| Repeal of Bush Tax Cuts | Set to Pre-2001 Levels | $276.8 |

| Totals (billions): | $674.0 |

WFF Reports

Other Reports

Carbon Tax

Carbon Tax Center

Gasoline

Taxation

New York Times - Real Men Tax Gas

Value-Added Taxation

Tax Policy Center - Value-Added Tax

The Cost of the Bush Tax Cuts

Center on Budget and Policy Priorities - Comprehensive Assessment of Bush

Administration's Tax Policies

BACKGROUND TAX INFORMATION

Tax Policy Center - International Comparison of US Rates

FINANCIAL TRANSACTIONS TAX

WFF: Financial Transactions Tax Report

This an interesting

idea that could raise $100 billion a year for a very small fee on financial

transactions.

Read more about it here.

TAXES ON SAVINGS AND INVESTMENT

MUST BE REDUCED

CAPITAL GAINS AND ESTATE AND GIFT TAXATION

America has among the world's lowest levels of savings, and this threatens our

ability to enact needed change.

See our page on this subject.

This is why we propose

lowering the estate tax and taxes on capital gains, which are high by

international standards. Indeed, we should consider either eliminating the

tax on long term capital gains or creating savings accounts where gains would be

tax-free until withdrawn.

In the case of the estate tax, our research suggests that this tax is really worse than nothing in so far as it creates a giant industry of legal and accounting projects that create huge levels of complexity and distort the flow of capital. A number of intelligent foreign countries have eliminated the estate tax.

Estate Taxation

WFF Estate Tax Report

Estate Tax Even Worse than Republicans Say (Tax Foundation)

Estate Tax Fails on All Fronts, Says New Joint Economic Committee Republican Study (Joint Economic Committee Republicans)

Capital Gains Taxation

Library of Economics and Liberty - Capital Gains Taxes

Alliance for Savings & Investment

RESEARCH AND DEVELOPMENT TAX CREDITSWe support efforts to make the research and development tax credit permanent.

GOVERNMENT INVESTMENT SPENDING MUST BE RAISED

We don't have exact plans here but combinations of tax incentives and government

funding are needed. These proposals include government research funding.

SOLAR POWER

Solar is the crown jewel of renewable energy technology.

A key asset of solar is the ability to create a local energy economy. This

is particularly relevant in poor nations by removing the need for huge power

lines.

Solar

Energy Industry Association - Treasury Program 1603

WORLD

FUTURE FUND REPORT ON RENEWABLE ENERGY

BATTERY TECHNOLOGY

To make electric cars and other parts of the new economy work we need major innovations in battery technology.

NATIONAL BROADBAND

Just as in 19th century the

American government subsidized the railroads, we need a policy that make high

speed broadband available to all.

See WFF Report on National Broadband Strategy.

Broadband.gov - Goals and Action Items

National Wireless Broadband Will Spark Innovation

Broadband for America

HIGH SPEED RAIL AND MASS TRANSIT

America is the only modern state without a high speed

rail network. A Boston to Washington DC high speed rail line would save

huge amount of money and energy.

Far more money is also needed for local mass transit. America is one of

the few major nations without rail links to most key airports.

US High Speed Rail Association - The Benefits of HSR in America

Amtrak - A Vision for HSR in the Northeast Corridor PDF

Building America's

Future - Railways (Scroll down on the page to find railways)

INFRASTRUCTURE SPENDING

Rebuilding crumbling bridges, dams, and highways is vital to the safety of the public, and provides needed employment.

Building America's Future Educational Fund

American Society of Civil Engineers

Report Card Excellent study of America's decaying infrastructure.

NATIONAL INFRASTRUCTURE INVESTMENT BANK

Borrows $60 billion of federal funding over ten years, and leverage $500 billion

in private investment.

Sen. John Kerry

and Tom Donahue - Building a US Infrastructure Bank

REFORM OF U.S. HEALTHCARE AND EDUCATION INDUSTRIES

These are two huge areas where America spends far more than other nations as a share of GNP and gets less.

Many Americans are calling for more education spending. However, as a percentage of GNP America is already spending far more than any other modern state and getting dismal results. See our report.

Obviously, more spending is not the solution here. In particular, mindless faith in sending people to college is an idea whose time has come and gone. We need intelligent job training for real world jobs. A national broadband strategy is essential here.

In healthcare, America has a total disaster on its hands. While spending more than any other modern state, America can't even insure some 30 million of its people. It's time to look at what every other state does, government single payer plans. We also need to look at the vast sums of money being spent to keep alive people who are for all intents and purpose dead as is detailed in this 60 Minutes Report.

Obama's plan leaves out 30 million people and is a bureaucratic mad house.

One thing that should not happen until the system is reformed is cuts in health care for the poor. Indeed, we would favor more health care for the needy now. In our view, this could actually save money by reducing the spread of disease and absences from work in society.

WFF Report on Need for Single Payer National Health Insurance

Another program that should not be cut is family planning and sex education. This prevents unwanted pregnancies and disease.

Unfortunately, many proposed cuts seem to be going in precisely the wrong directions.

SOCIAL SECURITY

Some liberals claim Social Security is solvent. We disagree. The entire government is a financial mess. Social Security's "solvency" is dependent upon the value of US government debt. We are very opposed to cuts for recipients. However, we would consider raising the retirement age. We should also raise the Social Security tax for upper income people. We do not favor Obama's plan to cut benefits via "chained CPI".

MILITARY SPENDING

Does America really need to spend more on "defense" than the next ten nations in the world combined? Obama has expanded Bush's war campaigns, not reduced them. Can these kinds of imperial costs continue? We think not. It's time to scale back defense spending and make NATO allies pay their share of an alliance that is supposed to be mutual.

CONCLUSIONS

These are not exact proposals but they do show the scale of problems. Unfortunately, we see few solutions in official Washington that make sense. Many solutions will make matters worse. Environmental and renewable energy programs are way below where they were in 1980 and yet many conservatives want to cut them more. Some "experts" are proposing tax "reform" budget proposals that reduce incentives for investment rather increasing them. The 1986 tax bill is a case study of what not to do. The Simpson-Bowles plan ignores consumption taxation and also goes in the direction of the 1986 bill.

Today America resembles New York City before it went bankrupt. To keep borrowing costs down, modern American debt, unlike the debt of World War II, is largely short term debt. The American government needs trillions in new debt and refinanced old debt to stay in business. Meanwhile, interest rates have been held down by money printing from the Federal Reserve. Any return to normal interest rates could cause the deficit to explode.

Time is running out.